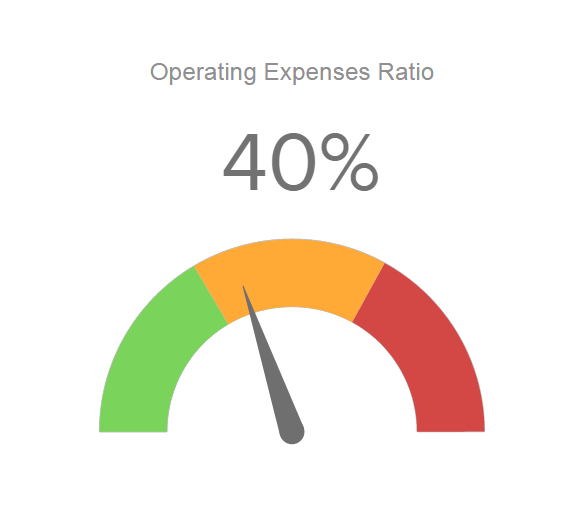

Tenants typically pay a fixed monthly rent per square foot (“ gross lease”). Office towers typically have the highest OER. In this case, the tenant might pay for cleaning, utilities, and common area maintenance while the landlord covers taxes, insurance, and building maintenance. In a modified gross lease, the tenant and landlord share responsibility for costs. What is a typical operating expense ratio for office properties?įor office buildings, a good operating ratio usually falls between 35% and 55%, depending on the lease terms.Ī low operating expense ratio would typically correspond to a property leased under a triple net lease agreement, which assigns sole responsibility to the tenant for all costs. However, it’s important to compare properties locally as expenses can vary between municipalities. What is a typical operating expense ratio in multifamily?įor apartment buildings, a good operating ratio usually falls between 35% and 45%. An increasing OER could mean wasteful spending, old utility equipment, bloated payroll, or any number of issues. Remember to do a year-by-year comparison of the operating expense ratio to identify trends over time. Energy costs might significant in an office building but not so at a mobile home park. Advertising/marketing costs may be substantial for a new apartment complex in lease-up, but minimal or non-existent for an industrial property. For instance, multifamily owners can pass costs to their tenants such as electricity, heat, and other utilities. What is a good operating expense ratio in commercial real estate?ĭifferent property types have different expense structures. Likewise, a higher OER often means there is upside potential. That means the OER is 35.7%:Ī lower OER generally implies that a property is well-run. The property generates $2,987,100 in Effective Gross Income and has total operating expenses of $1,065,000. Take a hypothetical example of Investor A who owns a 92,043 sq ft multi-tenant office building in Texas. What is an example of an operating expense ratio? The larger your vacancy, the more skewed OER might be. Some costs, like utilities, however, may be paid directly by a tenant and can be shut off to a vacant unit.Ĭalculate the operating expense ratio after vacancy with EGI for a more accurate picture of your property’s operations. Loss of income (especially from a large tenant) can make it harder to cover those costs. When there is a vacancy at a property, the landlord will still be required to cover certain operating costs, like pro-rata taxes, insurance, and repairs and maintenance.

Vacancy reflects rental income that is lost because of space (or units in the case of residential real estate) that is not leased. Effective gross income takes into account vacancy at your property. Rather than Total Potential Income, it’s best to use Effective Gross Income (“EGI”) in the denominator. So, items like depreciation (non-cash), capital expenditures, and tenant improvement allowances are excluded from the ratio because they are not costs to help run the property. The operating expense ratio focuses on the day-to-day cash costs of running a property. Typical operating expenses for a commercial real estate property include: Operating Expense Ratio = Total Operating Expenses/Effective Gross Income What is included in operating expenses for real estate? The formula divides total operating expenses by the effective gross income of a property:

How do you calculate the operating expense ratio? As such, property owners do their best to minimize their asset’s operating expense ratio. The metric describes the rental income (after vacancy) that is consumed by the property’s operating expenses. The operating expense ratio, or “OER”, is a simple formula that’s easy to calculate and reveals how efficiently a property runs on a day-to-day basis.

0 kommentar(er)

0 kommentar(er)